More cavitating again today in the

bond and mortgage markets; yesterday the 10 yr

yield up 2 bps, this morning down 3 bps to 2.72%, 30 yr MBS prices this morning

prior to 9:00 +15 bps. Interest rates still tied up in very narrow ranges with

no momentum in either direction. On Thursday Janet Yellen goes before the

Senate banking Committee to testify about Fed policy, inflation and employment;

maybe something will come out of it that will break the current stable bond and

mortgage markets.

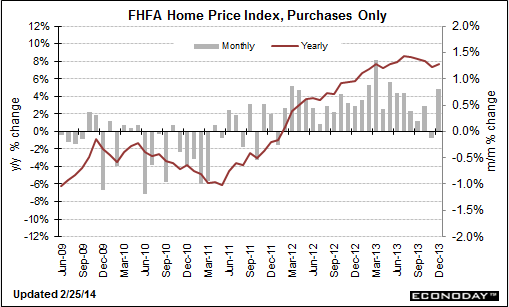

Another housing price index this

morning; the Dec FHFA Housing Price Index,

was expected to show a gain of 0.3%; as reported the index increased 0.8%,

yr/yr up 7.7%. If you don’t like one report you can chose the other. Data is a

subjective thing, it depends on how one decides to structure it. FHFA uses data

provided from FNMA and Freddie Mac.

At 10:00 the Feb consumer

confidence index from the Conference Board, expected

at 80.1 from 80.7, as reported the index fell to 78.1. The highest index

occurred last June at 82. The reaction pushed stock indexes lower and added a

little to the 10 yr yield to 2.71% from 2.72%, 30 yr MBS price increased to +25

from +14 at 9:30.

Like that broken record; the 10 yr

continues to hold minor positive readings.

For all the ink we put out and all the talk circulating the interest rate

markets refuse to crumble into bearish readings. That said, the bullish bias is

so weak that we don't yet have a lot of confidence in what way the 10 and MBSs

will break out of this flat trading.

No comments:

Post a Comment