A better start this morning for

the bond and mortgage markets with pre-market futures trading pointing to a

weak pen in the stock market. Stocks starting

lower, led by emerging markets, as shares in Russia headed for the longest

losing streak in seven weeks after Standard & Poor’s cut the country’s

credit rating. The ruble led currencies lower and oil declined. S&P cut

Russia to its lowest investment grade, saying further downgrades are possible

if economic growth deteriorates and the Ukraine conflict sparks wider

sanctions. Investors however don’t care much when the rating agencies decide to

downgrade or upgrade.

Russia/Ukraine;

Ukraine stopped its attacks on Russian speaking citizens that are holding key

buildings in the country. Russia moved its troops closer to the border and

increased military exercises with a display of air power. Putin has said any

more killing of Russian people will increase the likelihood Russia will move

into Ukraine to protect Russians who are increasingly demanding that east Ukraine

go back to Russia. The tensions have not lessened, in fact they have increased

and are leading an increase in safety moves into US treasuries and supporting

better MBS prices. John Kerry late last night warned Russia President Vladimir

Putin he’s running out of time to ease tension in Ukraine. Kerry said it will

be “an expensive mistake” if Putin does not meet commitments made at a meeting

in Geneva a week ago. While by blood runs red, white and blue; the reality is

the US has very little leverage in this situation.

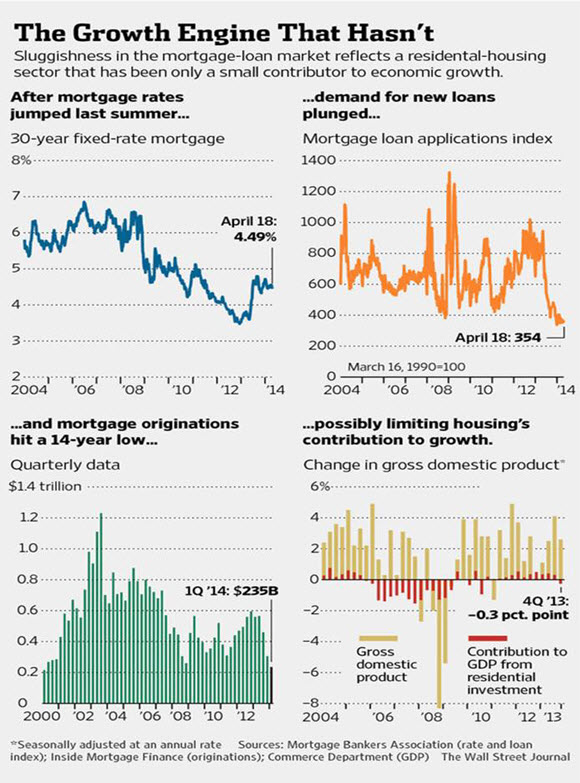

WSJ reporting this morning that

mortgage lending has declined to the lowest level in 14 years in Q1.

Lenders originated $235 billion in mortgage loans during the January-March

quarter, down 58% from the same period a year ago and down 23% from the fourth

quarter of 2013, according to industry newsletter Inside Mortgage Finance. The

decline in mortgage lending last quarter stemmed almost entirely from the slide

in refinancing. Loans for home purchases were basically flat from a year

earlier and down from the fourth quarter. These charts from the Journal tell

the story (a shame some of our readers will not be able to see the charts):

The Texas Real Estate Market is HOT and many buyers are losing to multiple offer situations. Read my article on how to WIN in multiple offer situations.

No comments:

Post a Comment