The Woodlands TX is a HOT real estate market!

A nice start this morning; the 10 yr note opened at 2.58%, its granite wall, 30 yr MBS prices early on up 15 bp from yesterday’s 33 bp increase. Tomorrow April CPI will be reported. The advance from the same month a year before was the biggest since March 2012 and followed a 1.4% yr/yr rise in the year to March. Inflation isn't increasing as much as the data suggested, not much interest in the increase due to one-off issues.

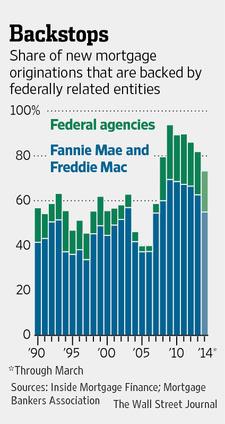

We reported yesterday that FHFA is

going to begin relaxing credit and down payment constraints in the mortgage

market. The new director Mel Wall is turning his back to the stringent

credit and down payment rules set out by our main man Barney the Frank and

Chris Dodd and the then acting director of FHFA Mr. DeMarco. Finally Washington

is getting the message, without improvement in the housing sector the economy

will continue with little growth as it has been doing since the Dodd/Frank bill

that was rammed through Congress in a panic mode led by Barney Frank. An easing

in credit, down payments and risk retention forced on banks is coming as Wall

St formulates the details. Even most of the minions in Congress are beginning

to understand that without housing the economy will not return to solid strong

growth.

Nothing new in Ukraine/Russia

situation overnight; the Ukraine vote on the

presidency is still scheduled for May 25th. Until then we don’t expect much to

occur but there will still be a safe haven traded in US treasuries keeping

rates low. As we reminded yesterday, the safest sovereign debt, the US Treasury

debt, is at higher interest rates than rates in Germany and other ‘safe

countries’ so foreign investors are attracted to the US 10 yr if looking for a

safe haven to park money in case the geo-political scene boils over.

Nothing left on the schedule

today; all about watching the stock market and the 10 yr note. From a

technical perspective a close below 2.57% should drive rates lower on a

breakout of the recent tight range. Janet Yellen is scheduled to speak tomorrow; her remarks

thus far have moved markets. She put her foot in it a few weeks ago when she

said in effect the Fed would begin increasing interest rates in mid-2015. Since

that she has swung back to data dependent as the trigger to increase rates. She

and Treasury Sec Lew last week were sounding an alarm about the housing sector

keeping the economy from growing more rapidly.

At this point I would suggest to float your interest rate on the hope that rates will decrease slightly. Remember we have our FREE float down option that allows you to float your rate down if they decrease.

No comments:

Post a Comment