September unemployment down to 5.9% from 6.1% in August; the best in six years. Non-farm jobs expected +215K at +248K; July and August revisions added an additional 69K from original reports. Private jobs were expected 215K, as reported +236K. The U-6 unemployment rate at 11.8% from 12.0% in August; U-6 is the number of workers that want full time jobs but are working part time jobs, or can’t find a good full time job. The Sept jobs increase is the best since June; over the past three months, the economy added an average of 224,000 jobs, roughly in line with the average of 228,000 in the first six months of the year. Average hourly earnings for private-sector workers fell a penny to $24.53. Earnings were up 2% compared with a year earlier, still not much growth. The unemployment rate the best in six years.

The trade deficit in the U.S.

unexpectedly shrank in August to the lowest level in seven months as

exports edged up to a record. The gap decreased 0.5% to $40.1B, the smallest

since January, from a revised $40.3B in July, the Commerce Department reported.

Not a market mover but nice to see the deficit decline even a little, the US

needs increased exports but with the dollar increasing against other major

currencies exports will be more difficult to expect.

Interesting this morning; prior to

the employment data at 8:30 the key stock indexes were substantially better

than yesterday’s close, Europe’s market were

also better. Usually markets go into the employment report about unchanged from

the previous day. At 9:30 the DJIA opened +90 after trading +99 prior to

employment at 8:30, NASDAQ +26, S&P +9. 10 yr 2.46% +2 bp and 30- yr MBS

price. It only took a few minutes before the key indexes moved higher.

Volatility already this morning; within 20 minutes from the open the DJIA

climbed 170 points.

Ben Bernanke said today he didn’t

qualify to re-finance his home; joke or serious?

He pointed to the excesses of Dodd/Frank. For reasons not known CNBC continues

to bring Barney on for his incompetent comments. Dodd/Frank has done more to

keep the economy down than any other legislation in the last 50 years.

Another key data point just out;

Sept ISM services sector index, expected at 58.6 from

59.6; as reported the index was right on at 58.6. New orders better, employment

better.

Volatility this morning is high;

prices swinging in big moves; employment much

better on the headlines but let’s not forget about Europe likely headed to

recession with the ECB dragging feet with not much stimulus but a lot of

positive talk from Draghi not walking the walk. The 10 under pressure, MBSs

under pressure as we would expect with employment. The 10 not being hit too

badly at 2.47%, +3 bps. The near term support is 2.50% for the 10.

Inventory holds its own as home sales and prices continue to climb

Summer wrapped up on a high note for the Houston real estate market, as August delivered gains in both sales volume and prices. Housing inventory held steady month-over-month, but is tracking slightly below year-ago levels. While prices were the highest for an August, they fell short of the all-time records set in June.

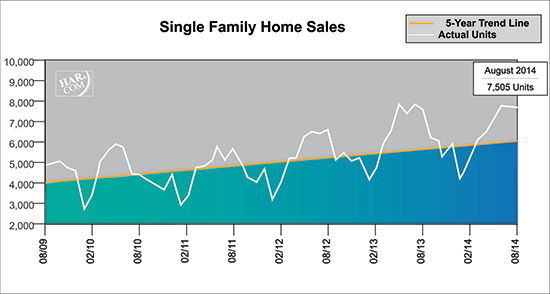

Single-family home sales totaled 7,505 units, up 1.1 percent versus August 2013, according to the latest monthly report prepared by the Houston Association of REALTORS® (HAR). Months of inventory, which estimates how long it will take to deplete current active housing inventory based on the previous 12 months of sales activity, matched July’s 3.0-months supply, but was down slightly compared to the 3.3-months supply of last August. It is significantly below the current national supply of 5.5 months of inventory.

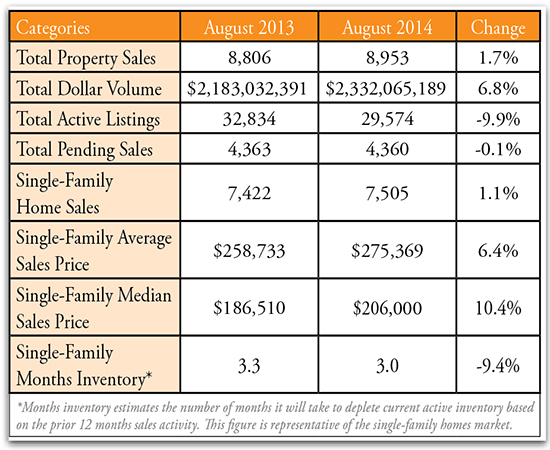

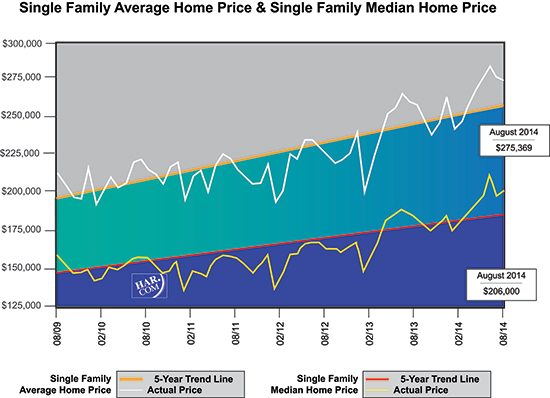

The average price of a single-family home rose 6.4 percent year-over-year to $275,369. The median price—the figure at which half the homes sold for more and half for less—jumped 10.4 percent to $206,000.

August sales of all property types totaled 8,953 units, a 1.7-percent increase compared to the same month last year. Total dollar volume for properties sold rose 6.8 percent to $2.3 billion versus $2.2 billion a year earlier.

“The Houston housing market is going strong as we transition from summer to fall, and enough new listings have hit the market over the past month to keep inventory levels stable,” said HAR Chair Chaille Ralph with Heritage Texas Properties. “One of the factors that continues to fuel real estate and our local economy in general is the ongoing creation of jobs. Houston is definitely a desirable destination for many people across the country.”

In its September 2014 Economy at a Glance report, the Greater Houston Partnership stated that the Houston metropolitan area created 112,200 jobs in the 12 months ending July 2014, which represents a 4.0 percent annual growth rate. That puts Houston ahead of the nation’s major metros for job growth, ahead of Dallas-Ft. Worth (3.9 percent) and Miami (3.3 percent).

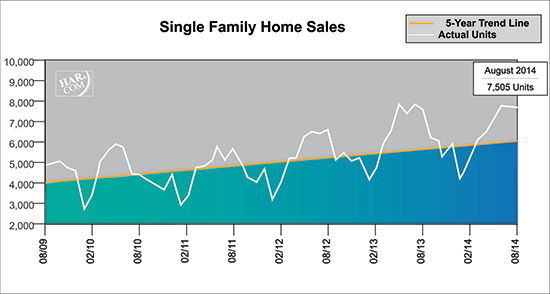

August Monthly Market Comparison

The Houston housing market saw growth in all measurement categories in August, with total property sales, total dollar volume and average and median pricing all up when compared to August of 2013.

The Houston housing market saw growth in all measurement categories in August, with total property sales, total dollar volume and average and median pricing all up when compared to August of 2013.

Month-end pending sales for all property types totaled 4,360. That is statistically flat compared to last year and may potentially signal a slowdown in sales activity when the September numbers are tallied. Active listings, or the number of available properties, at the end of August was 29,574 and is 9.9 percent lower than last year.

Houston’s housing inventory, while slightly lower on a year-to-year basis, has held steady at a 3.0-months supply since July. It is down from the 3.3-months supply of August 2013 and below the current 5.5-months supply of inventory across the U.S. reported by the National Association of Realtors®.

Single-Family Homes Update

August single-family home sales totaled 7,505. That is up 1.1 percent from August 2013 and represents the third highest one-month sales volume of the year.

August single-family home sales totaled 7,505. That is up 1.1 percent from August 2013 and represents the third highest one-month sales volume of the year.

Home prices reached record high levels for an August. The single-family median price jumped 10.4 percent from last year to $206,000 and the average price rose 6.4 percent year-over-year to $275,369. Transactions overall closed at a near-record pace. The number of days a home took to sell, or Days on Market, was 46. In July it reached a record low of 45 days.

Broken out by housing segment, August sales performed as follows:

- $1 – $79,999: decreased 30.7 percent

- $80,000 – $149,999: decreased 12.8 percent

- $150,000 – $249,999: increased 2.8 percent

- $250,000 – $499,999: increased 13.4 percent

- $500,000 – $1 million and above: increased 15.7 percent

HAR also breaks out the sales performance of existing single-family homes for the Houston market. In August, existing home sales totaled 6,608. That is 0.2 percent ahead of the same month last year. The average sales price increased 5.7 percent year-over-year to $260,031 while the median sales price jumped 9.3 percent to $192,000.

No comments:

Post a Comment